Market liquidity refers to how quickly and easily an asset can be bought or sold without significantly affecting its price. In other words, liquidity determines how smoothly trades happen - and that directly affects a trader’s experience.

On Deriv, liquidity matters because it controls your execution speed, spreads, and trading costs. When markets are liquid, your trades are executed almost instantly, at the price you expect, with minimal slippage. But when markets dry up, spreads widen, execution slows, and trades may fill at worse prices - a direct hit to profitability.

Think of liquidity as the engine oil of trading: invisible when it’s working, but everything grinds when it’s not.

Quick summary

- Liquidity: On Deriv, the most liquid assets include forex majors, major indices, gold, oil, and BTC/USDT.

- Why it matters: Tighter spreads, faster execution, lower slippage, and more stable prices.

- Illiquid markets = higher risk: Exotic forex pairs and smaller cryptos often have wider spreads and unpredictable fills.

- Best practice: Start with liquid assets to keep costs low and manage risk, then explore less liquid markets as your strategy evolves.

Now that you know why liquidity matters, let’s look at how it actually shapes your trading experience on Deriv.

How liquidity affects your trading costs on Deriv

Unlike many brokers, where low-liquidity periods often lead to wider spreads and slower fills, Deriv’s millisecond-execution infrastructure helps maintain stable pricing and smooth trade flow even during volatile sessions.

On Deriv, liquid markets feature:

- Tight spreads (major forex pairs like EUR/USD).

- High trading activity (indices like the S&P 500).

- Deep markets (commodities like gold and oil).

High liquidity absorbs sudden buying or selling pressure, helping to stabilise prices even during volatile periods. By contrast, illiquid assets such as exotic forex pairs or smaller cryptos can have wide spreads and higher slippage, making them costlier to trade.

With the basics covered, let’s explore which markets on Deriv offer the highest liquidity and how they compare.

How market liquidity works

According to Investopedia, the forex market - with trading volumes of $7.5 trillion daily - is the most liquid in the world. On Deriv, this liquidity is most visible in major pairs like EUR/USD, GBP/USD, and USD/JPY. Other highly liquid markets include major indices (S&P 500, NASDAQ, FTSE 100), blue-chip stocks (Apple, Microsoft, Tesla), commodities like gold and oil, and cryptos such as BTC/USDT and ETH/USDT.

Which markets offer the highest liquidity in 2025

- Forex market: The world’s largest and most liquid market, trading nonstop 24/5. On Deriv, majors like EUR/USD, GBP/USD, and USD/JPY offer the highest liquidity. Check out our Forex trading guide on Deriv Academy to see strategies tailored for these pairs.

- Major stock indices: Indices such as the S&P 500, NASDAQ, and FTSE 100 are highly liquid because they pool blue-chip stocks. On Deriv, they’re a popular choice for both short- and long-term traders.

Indices on Deriv reflect deep institutional order books,” notes Yoli, Head of Marketing. “That’s why traders see smoother fills on the S&P 500 CFDs compared to more volatile synthetic or niche assets.

- Blue-chip stocks: Companies like Apple, Microsoft, and Tesla are heavily traded. On Deriv, you can trade these via CFDs for exposure to high-liquidity equities.

- Commodities: Gold and crude oil are the standout liquid commodities. Gold remains one of the most heavily traded assets globally, with daily trading volumes often reaching $298 billion as of March 2025, according to the World Gold Council

- Cryptocurrencies: BTC/USDT and ETH/USDT are the most liquid cryptos on Deriv. Globally, Bitcoin and Ethereum account for more than 60% of total crypto market liquidity.

Comparative liquidity on Deriv

Compared to traditional brokers, Deriv’s liquidity model aggregates prices from multiple providers and executes trades in milliseconds. This keeps spreads tight and trading costs efficient, even during volatile market conditions.

Knowing where liquidity is strongest is just the start - understanding why it matters for your trading results is what really counts.

Why trading in liquid markets matters for you

For traders on Deriv, high liquidity means:

- Tighter spreads → lower costs.

- Faster execution → critical for scalpers and day traders.

- Reduced slippage → more accurate entries and exits.

- More stability → large trades move the market less.

Of course, liquidity isn’t equal everywhere - when it dries up, trading conditions can change dramatically.

The risks of trading in illiquid markets

Illiquid markets available on Deriv - such as exotic forex pairs or smaller cryptos - carry risks such as:

- Wider spreads → higher trading costs.

- Harder entries/exits → positions may not close where expected.

- Greater volatility and manipulation risk → sudden spikes can occur.

Deriv Case Study: Trading USD/TRY outside peak hours can result in spreads several times wider than EUR/USD. Similarly, trading small-cap altcoins exposes you to thin order books where even modest trades trigger sharp moves. On Deriv MT5, spreads on exotic pairs like USD/TRY can widen to over 10 pips during low-liquidity sessions, compared to under 1 pip on EUR/USD.

Fortunately, identifying liquid markets on Deriv is straightforward once you know what to look for.

How to check liquidity levels before placing trades

Once you understand how liquidity impacts costs and risk, the next step is to know how to assess it in real-time. Here’s how you can identify and trade liquid markets on Deriv effectively.

How to identify and trade liquid markets on Deriv - step by step

Follow these simple steps to identify high-liquidity assets on Deriv before placing a trade:

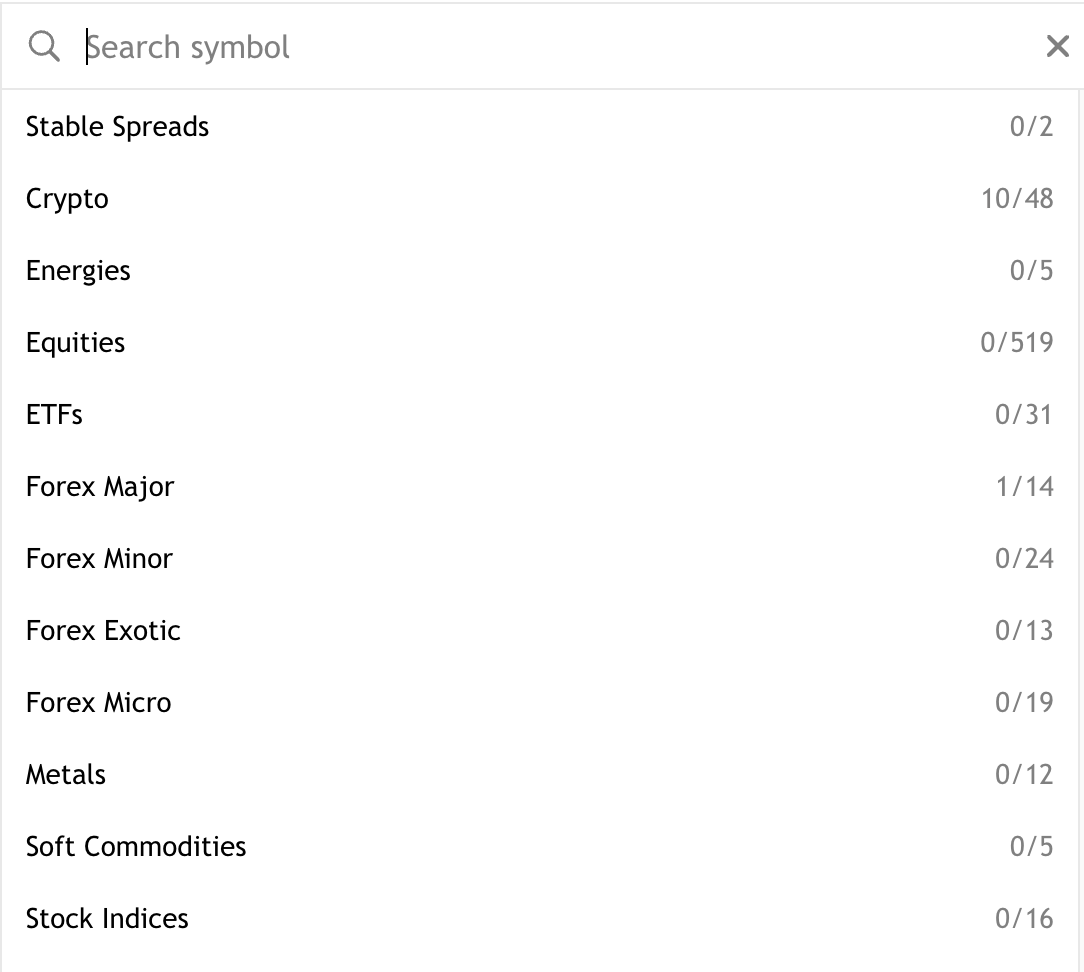

Step 1: Log in to your preferred platform

- Choose either Deriv MT5 or Deriv cTrader.

- Open the “Market Watch” or “Symbols” panel.

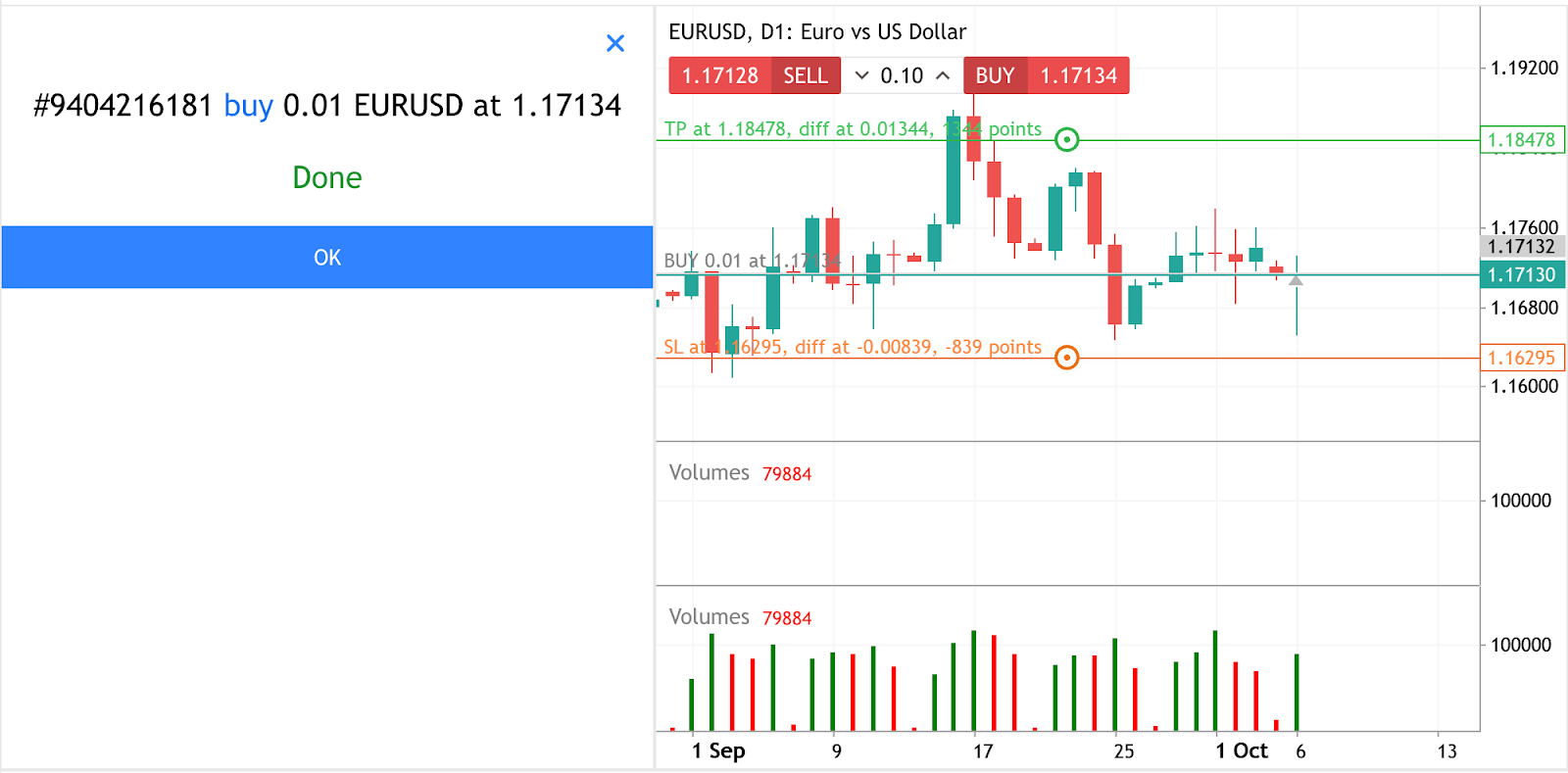

Step 2: Check the spreads

- Look at the Bid and Ask prices for popular assets.

Step 3: Observe execution speed

- Open a small test trade during active trading hours.

- Note how quickly the order fills - fast execution (usually under a second) signals strong liquidity.

Step 4: Use the Depth of Market (DOM) tool (Deriv cTrader only)

- Open the DOM panel for your chosen asset.

- A “deep” order book - with multiple buy and sell levels close to current price - indicates high liquidity.

Step 5: Apply liquidity data to your strategy

- Scalpers: Trade during peak hours (e.g., London–New York overlap).

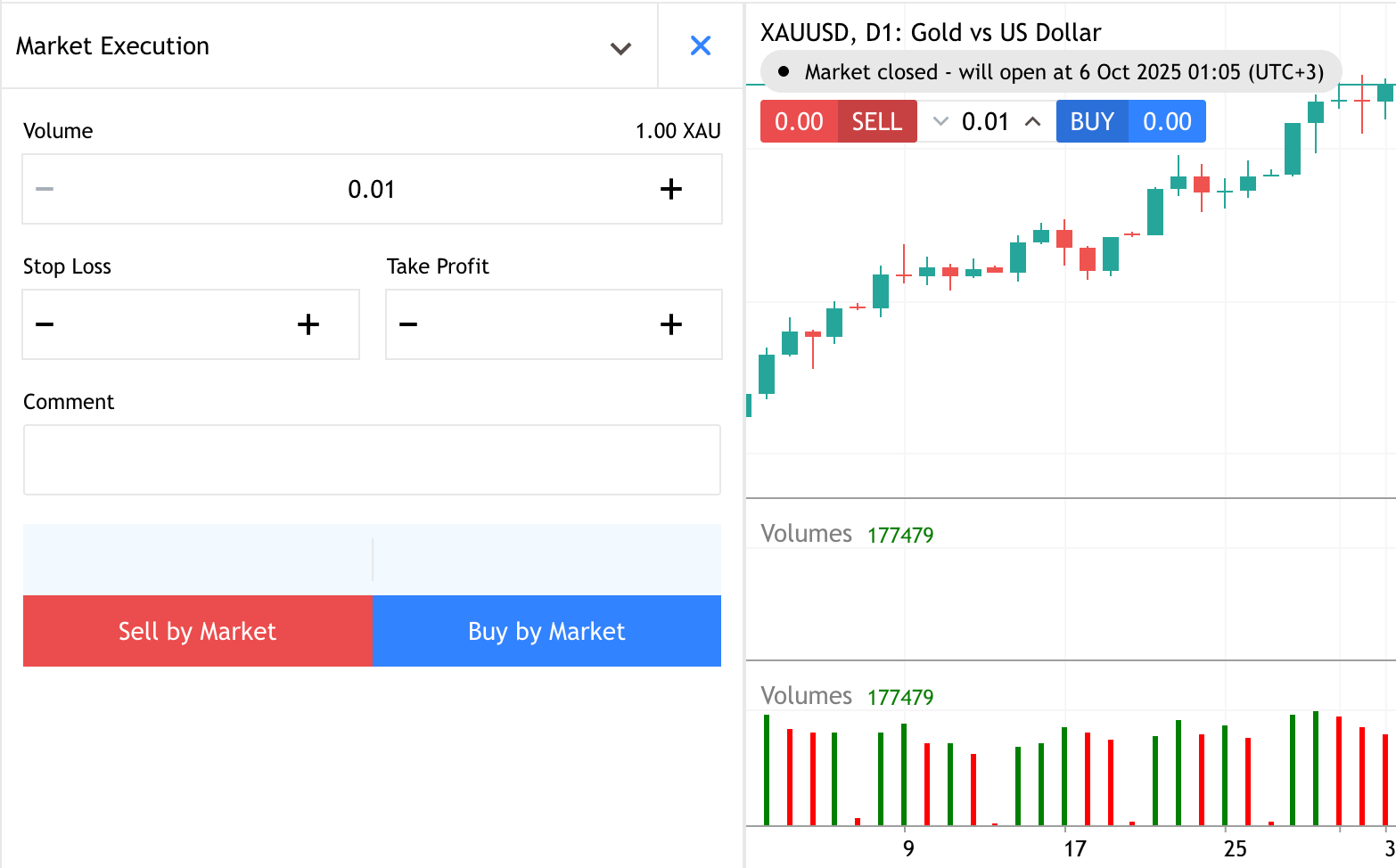

- Swing traders: Choose assets with consistent liquidity like Gold or S&P 500 CFDs.

- Crypto traders: Stick to BTC/USDT or ETH/USDT for smoother execution.

Trader insight:

Combine spread analysis, execution tests, and DOM depth checks for the clearest picture of liquidity. Consistency across all three could mean you’re trading in a highly liquid market - ideal for minimising slippage and cost.

Best strategies for trading in highly liquid markets

- Scalping on forex majors: Tight spreads + rapid execution on EUR/USD make it ideal for short bursts of trading.

- Swing trading in commodities: Gold’s liquidity supports medium-term opportunities for trend-following traders.

- BTC/USDT volatility plays: Liquid crypto pairs allow traders to capitalise on big moves while enjoying smoother execution.

How to match liquidity levels to your strategy

Risk control: Use stop-loss and limit orders confidently in liquid markets - they’re far more likely to fill at their intended levels.

Forex is the most liquid market, followed closely by major indices, blue-chip stocks, gold and oil, and top cryptos. On Deriv, these markets offer tight spreads, fast execution, and reduced slippage, giving traders more control and stability.

Illiquid assets can be tempting, but they bring higher risks. Traders who focus on liquid markets first can trade with confidence, reduce costs, and manage risk more effectively.

For more practical strategies, visit Deriv Academy to sharpen your skills.

Quiz

Which type of market on Deriv typically offers the highest liquidity and tightest spreads?