Commission-free trading has transformed how traders engage with the markets. This guide explains how Deriv’s zero-commission model works, who benefits most, and how it helps cut costs and boost efficiency across forex, commodities, and synthetic indices.

With zero-commission trading, you can buy and sell without per-trade fees - helping traders of all levels lower expenses and keep more of their profits.

Quick summary

- Zero-commission model: replaces flat fees with spread-based costs.

- Low entry barriers: ideal for beginners starting small.

- Commission-free on Deriv Trader & MT5: access forex, commodities, and synthetics.

How zero-commission trading works

It’s simple: you pay no per-trade commission - only the bid–ask spread and any overnight swap. The spread is your main cost: it tightens in liquid markets and widens during volatility as liquidity providers adjust pricing.

Example: if EUR/USD is 1.1000 / 1.1002, the 2-pip difference is your cost. Overnight holds may incur positive or negative swaps.

Your Effective Cost of Trade (EOT) ≈ spread ± slippage + swap.

With zero commissions, total cost depends mainly on timing, order type, and slippage.

Deriv MT5 supports automation and filters, while Deriv Trader shows live spreads for real-time verification.

Understanding spreads in zero-commission trading

In zero-commission trading, the spread replaces the flat trading fee. At Deriv, EUR/USD spreads start from 0.5 pips, with majors generally tighter than minors or exotics.

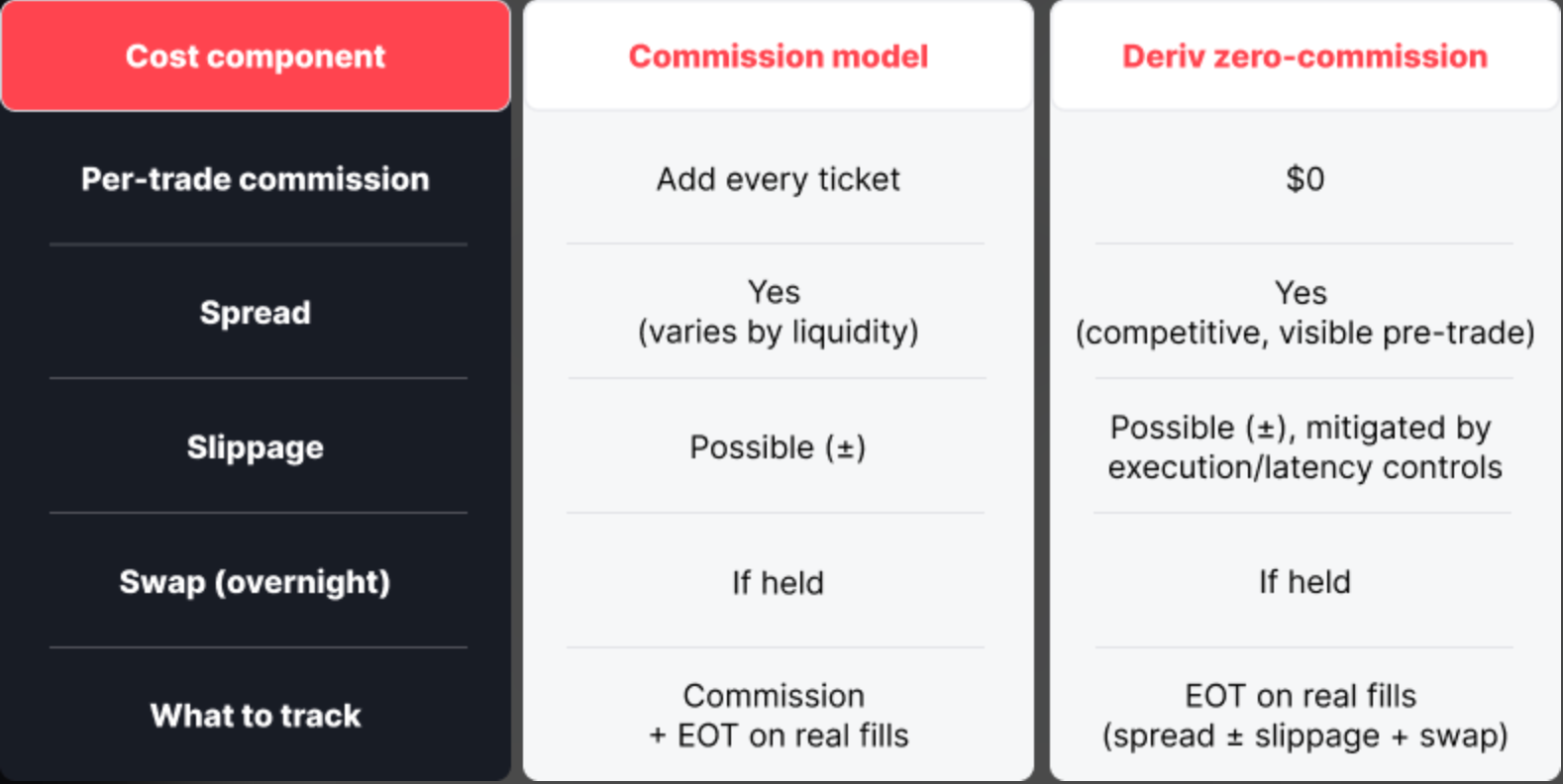

Let’s compare how trading costs differ between a traditional commission model and Deriv’s zero-commission setup.

Commission vs. Zero-commission

Commission-free trading rewards active traders and spares beginners flat fees. In forex, you only pay the spread and any slippage - no per-trade costs.

Predictable costs make this model powerful. “For active traders, it’s a game-changer in managing profitability,” says Prakash Bhudia, Deriv’s Head of Trading & Growth.

Since adopting zero-commission trading, brokers have seen retail assets rise by 7%, while those still charging commissions dropped 9%. Regulators now focus on execution quality and transparency, with new SEC rules helping traders compare real costs.

Here’s how the cost difference plays out across various trade sizes and frequencies.

To see how costs accumulate under both models, here’s a side-by-side breakdown of what makes up the total trading expense.

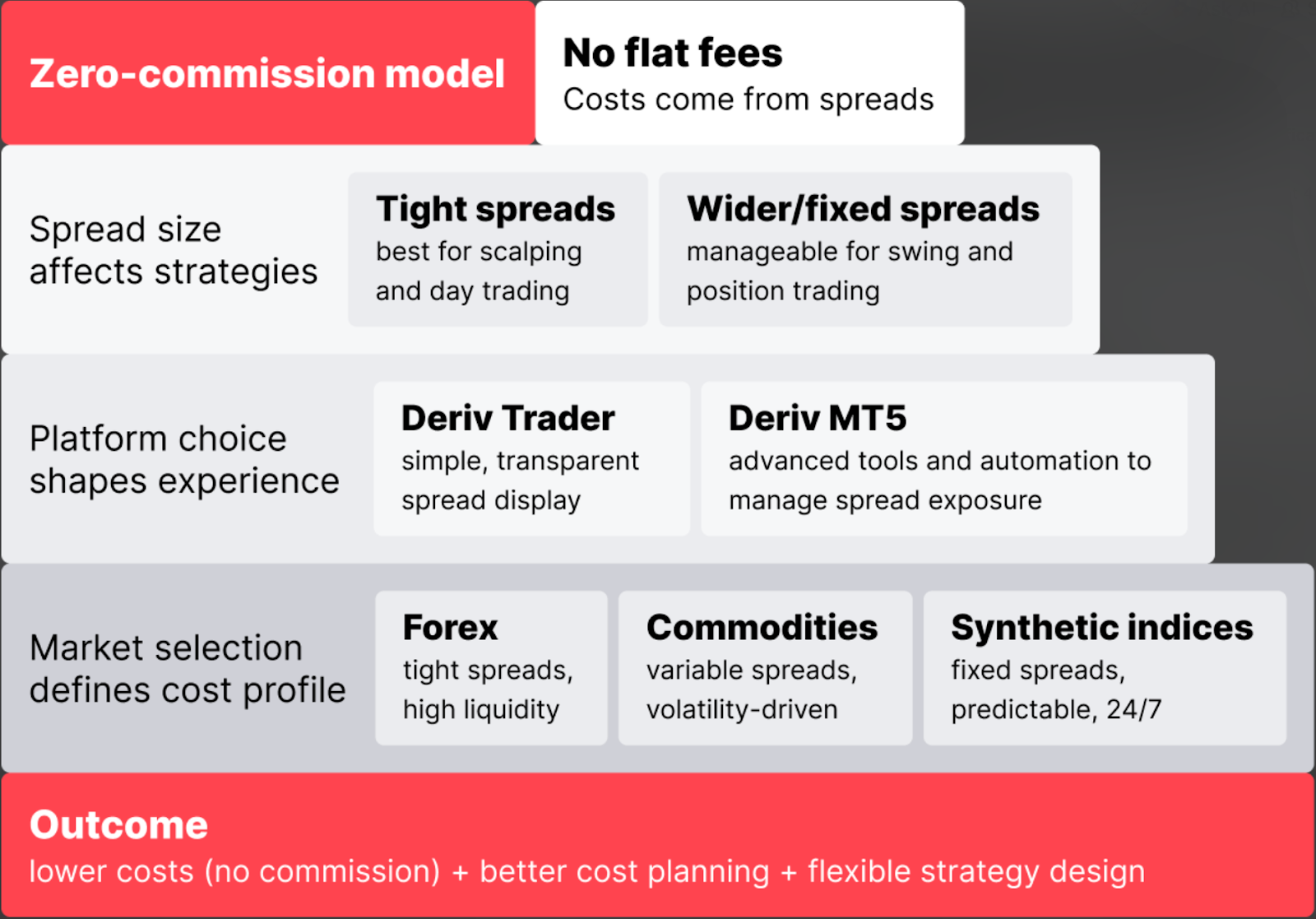

Zero-commission trading model (stacked costs)

Per-trade commission → + Spread → ± Slippage → + Swap if overnight → Effective Cost of Trade EOT

Deriv zero-commission model (stacked costs)

Spread → ± Slippage → + Swap if overnight → Effective Cost of Trade EOT

The table below highlights how the two models perform under identical market conditions.

Let’s look at how much traders can actually save with Deriv’s zero-commission model in real scenarios.

Case study: Savings by trading style

Here’s an example of how an active trader benefits when trading frequently.

Trader A - Active day trader

- 100 trades per month.

- Traditional broker = $500 commissions.

- At Deriv = ~$200 in spreads.

Saves $300.

On the other hand, here’s what the savings look like for a less frequent, swing-style trader.

Trader B - Casual swing trader

- 10 trades per month.

- Traditional broker = $50 commissions.

- At Deriv = <$20 in spreads.

Saves $30.

Key benefits of zero-commission trading

- Lower costs: No flat commission charges.

- Transparency: Costs visible in spreads and swaps.

- Scalability: Ideal for testing strategies or running multiple positions.

According to Investopedia, traditional brokers charge $4.95 per trade. At 100 trades per month, zero-commission trading saves $500–$700.

Now that we’ve covered the basics, let’s explore how this model works across different market types.

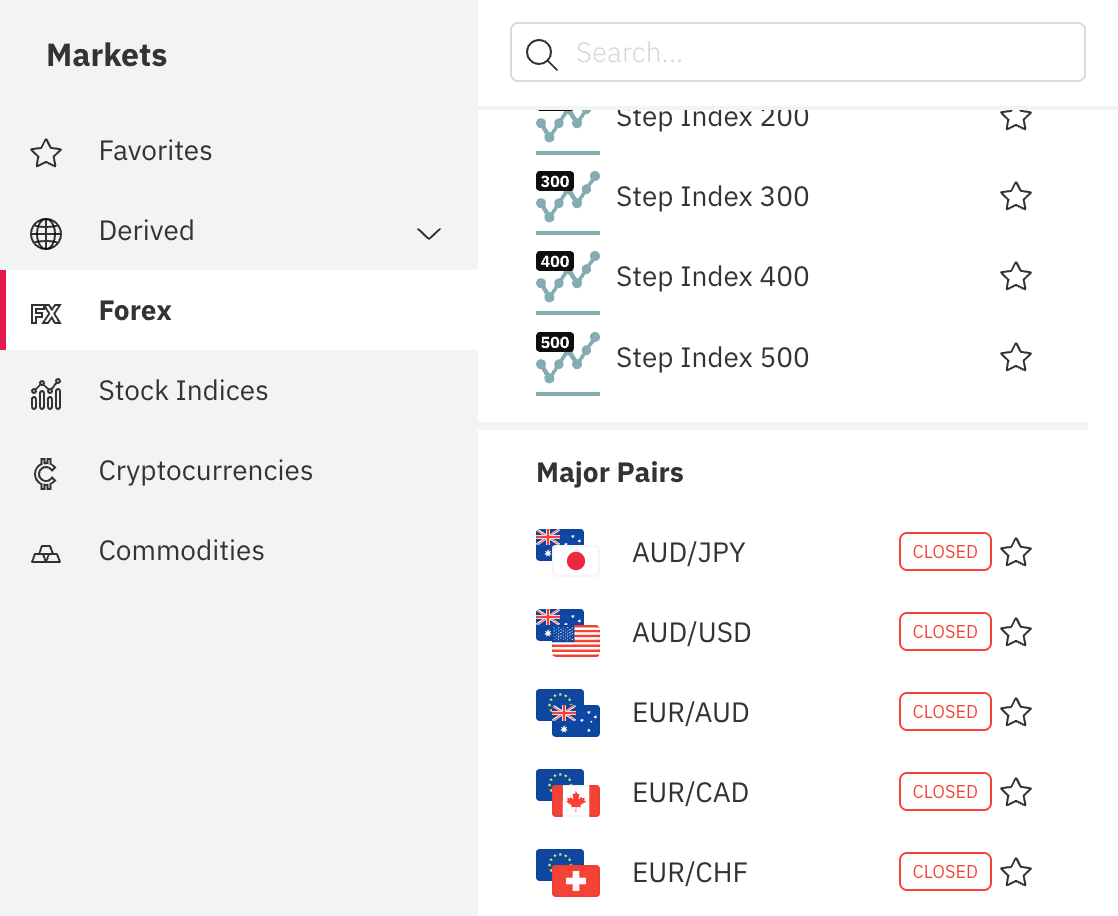

How zero-commission trading applies across markets

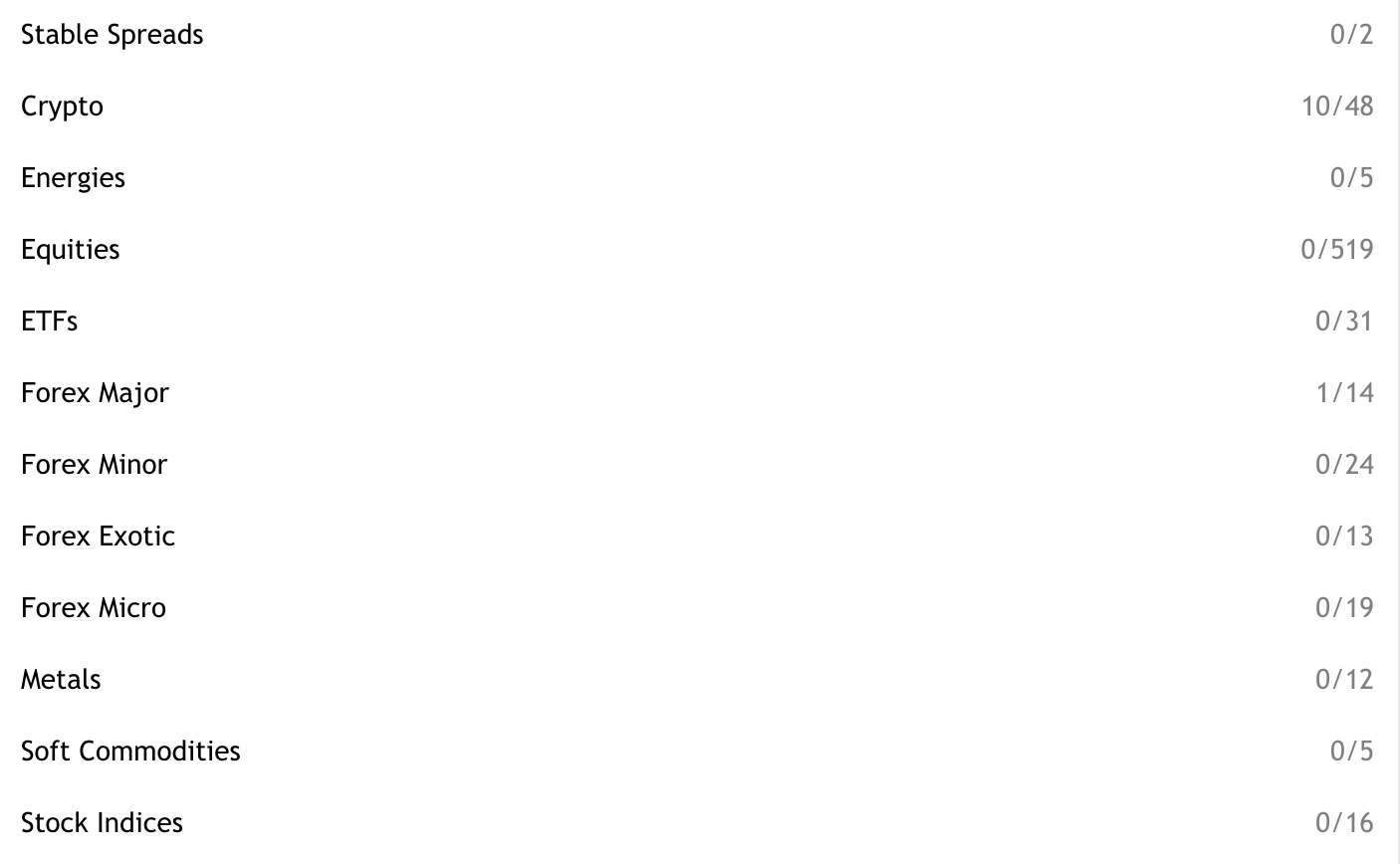

Zero-commission trading applies across all deriv markets.

Forex: Majors (EUR/USD etc) = tightest spreads in London–NY overlap.

Commodities: Spreads widen around major news.

Synthetics: 24/7 fixed spreads for predictable costs.

Synthetic indices are a unique part of Deriv’s zero-commission offering - here’s what sets them apart.

What are Deriv synthetic indices?

Deriv’s synthetic indices trade 24/7, mimic real volatility, and feature fixed spreads for consistent, automated trading.

Unlike forex or commodities, pricing stays stable - your total cost depends only on spread, trade size, and holding time, not commissions.

How synthetic indices differ from traditional ones

Synthetic indices move by algorithmic volatility, not company data or macro events. They offer 24/7 access, fixed spreads, and transparent costs (spread + swap). Traders value them for predictable behaviour, reliable backtesting, and automation on Deriv MT5.

Deriv’s execution quality

Built for speed, reliability, and transparency.

- Price quality: Competitive bid/ask pricing shows true spread costs upfront, and low-latency infrastructure minimises slippage.

- Resilience: Redundant systems and real-time monitoring ensure consistent execution - vital for 24/7 synthetic indices.

Let’s see how Deriv’s pricing and execution compare with industry standards.

Industry vs. Deriv approach

Here’s a quick overview of the main zero-commission markets and where you can trade them.

Zero-commission products at Deriv

For zero commission trading, majors often carry our tightest spreads (from 0.5 pips in favourable conditions), making frequent entries more cost-efficient.

To put Deriv’s model in context, here’s how it stacks up against common industry pricing structures.

How Deriv’s zero-commission model compares

Different brokers implement “no commission” in different ways. Below is a simplified comparison of common models.

While zero-commission trading has clear benefits, it’s important to understand where costs can still appear.

What to watch for in zero-commission trading

Zero-commission trading removes fees but not all costs. Your Effective Cost of Trade (EOT) still depends on spread, slippage, and swaps.

Hidden costs:

Spreads may widen during periods of volatility or off-peak hours; swaps apply overnight, and conversion or withdrawal fees can accumulate.

When it’s less ideal:

This model works best in liquid, tight-spread markets - costs rise during news events or thin sessions.

Here’s a quick example showing how spread and slippage can affect short-term trades.

Example – EUR/USD scalp:

With a 2-pip target and 0.8-pip spread, plus 0.5-pip slippage, your cost is about 1.3 pips ($13) - most of your $20 potential gain.

Lesson: Tight targets demand precise timing and low slippage.

How to keep trading costs low

Use limit orders to control entry and reduce slippage. Trade during high-liquidity sessions for tighter spreads, and monitor swaps on longer holds. Deriv MT5 tools and low-latency execution help keep overall costs predictable.

Zero-commission trading and Deriv’s trading platforms

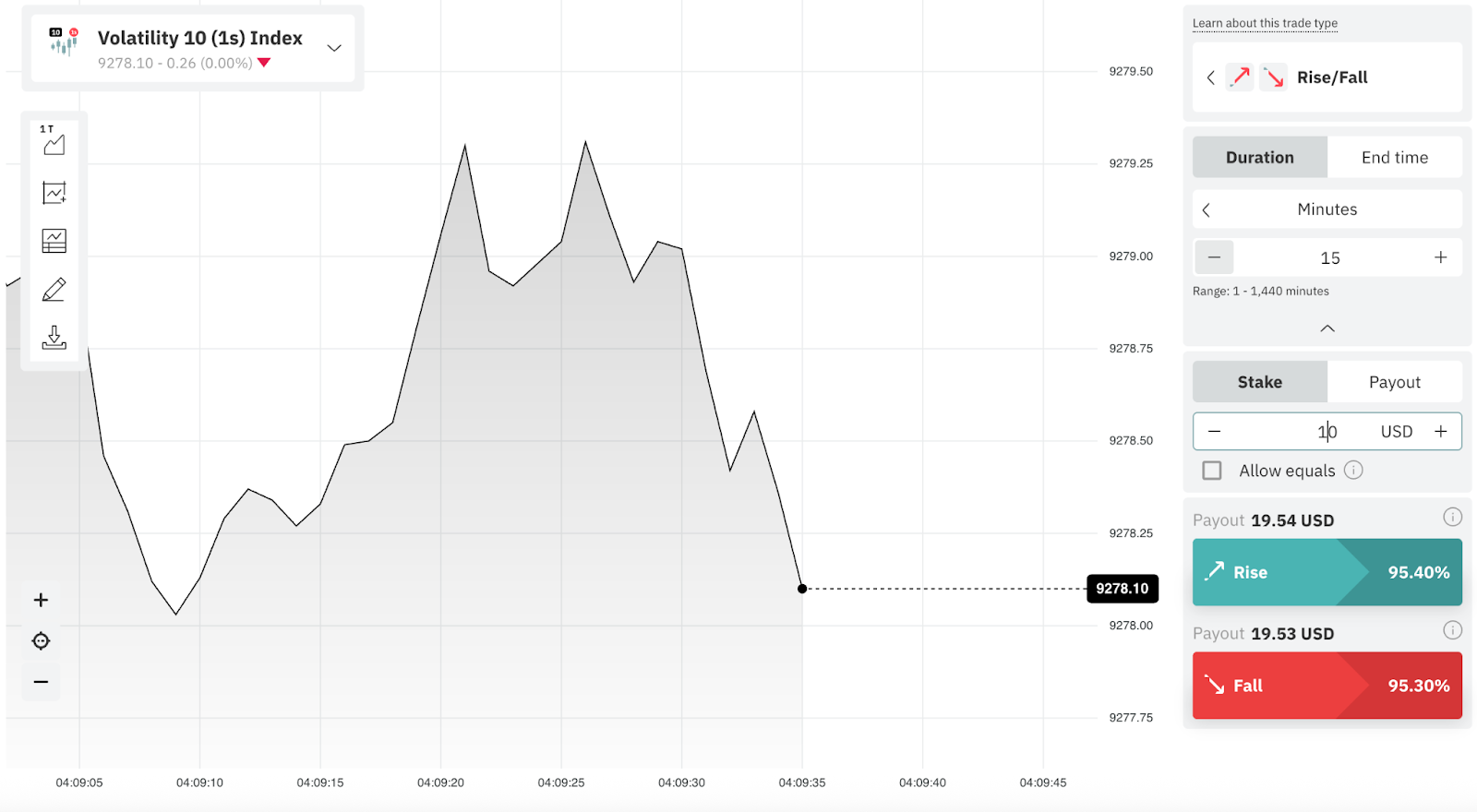

Zero-commission trading is Deriv's core model. The platforms - Deriv Trader and Deriv MT5 - act as gateways to commission-free access to forex, commodities, and synthetic indices.

Getting started with zero-commission trading

Step 1: Create an account by going to deriv.com

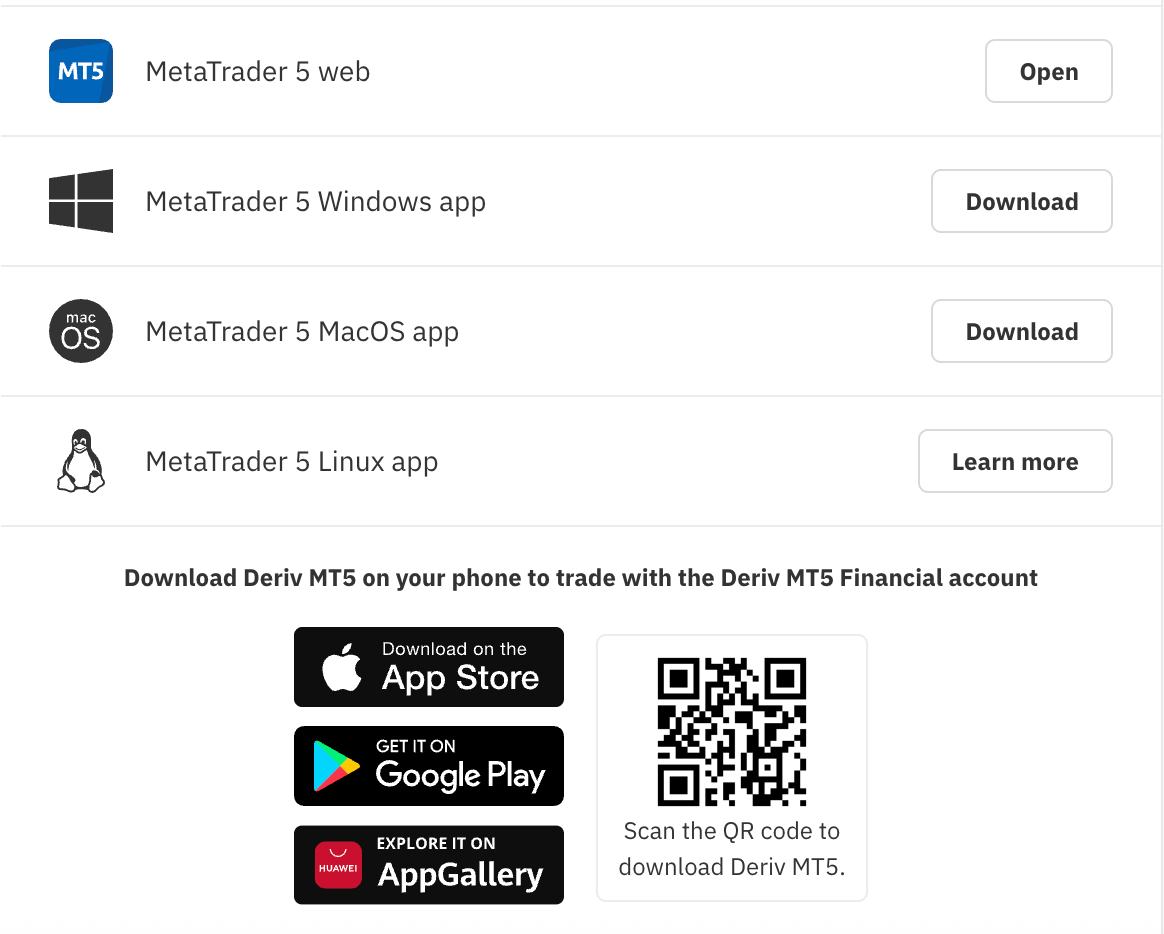

Prefer to trade on desktop? After signup, go to Traders Hub → Deriv MT5 and click Deriv MT5 download to install the desktop app.

- Sign up via email, Google, Meta, or Apple.

- Verify your email and log in.

- Click Traders Hub

- Click Create free demo account.

Step 2: Select your platform

- Deriv Trader

- Deriv MT5 dashboard.

Step 3: Choose a product to trade

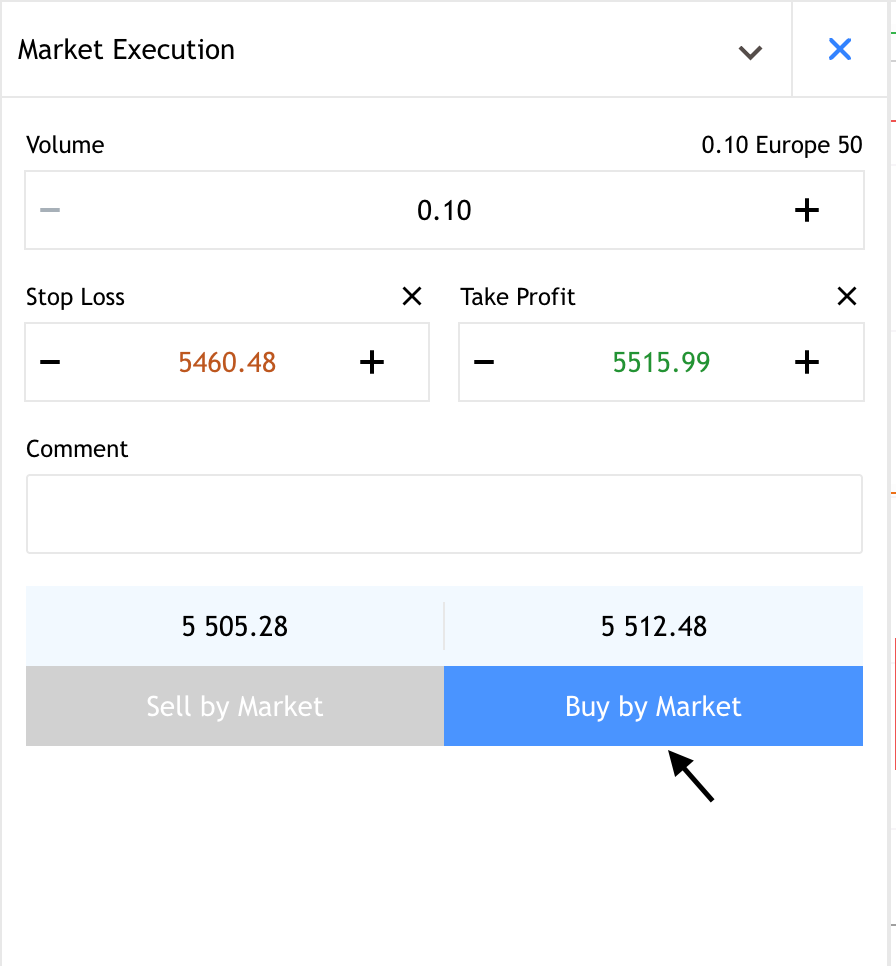

Step 4: Place your trade

- On Deriv Trader: choose asset → set stake/direction → confirm.

- On DMT5: right-click → New Order → confirm.

Step 5: Manage overnight positions

- Monitor swaps before rollover.

- Scale or close trades early if needed.

Quiz

In Deriv’s zero-commission trading model, what is your main trading cost?